Liability Insurance Law In North Carolina

Use this page to navigate to all sections within Chapter 58.

Liability insurance law in north carolina. Heres more useful information about the auto insurance requirements in North Carolina. 25000 for property damage in any one accident. This is FindLaws hosted version of North Carolina General Statutes Chapter 58.

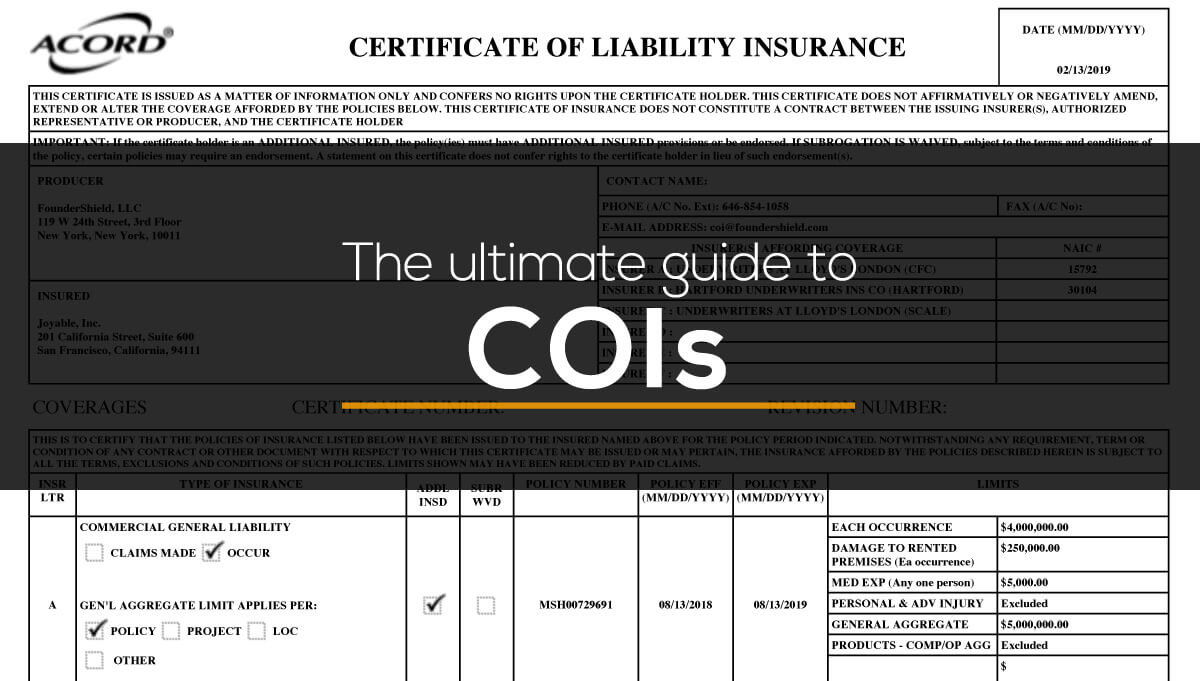

Each driver must be listed on the document provided for liability insurance when applying as a new driver. A A person who claims to have been physically injured or to have incurred property damage where such injury or damage is subject to a policy of nonfleet private passenger automobile insurance may request by certified mail directed to the insurance adjuster or to the insurance company Attention Corporate Secretary at its last known principal place of business that the insurance company provide information regarding the policys limits of coverage. This is one of the most valuable services an attorney can provide in a premises liability case.

Liability insurance must be issued by a company licensed to do business in North Carolina. North Carolina is one of only a few jurisdictions which still adheres to the strict doctrine of contributory negligence Pursuant to this doctrine if a plaintiff sues a person under a theory of negligence the plaintiff will not be entitled to recover if his injuries were caused by his own negligence even in the slightest. Find Your Best Rates Now.

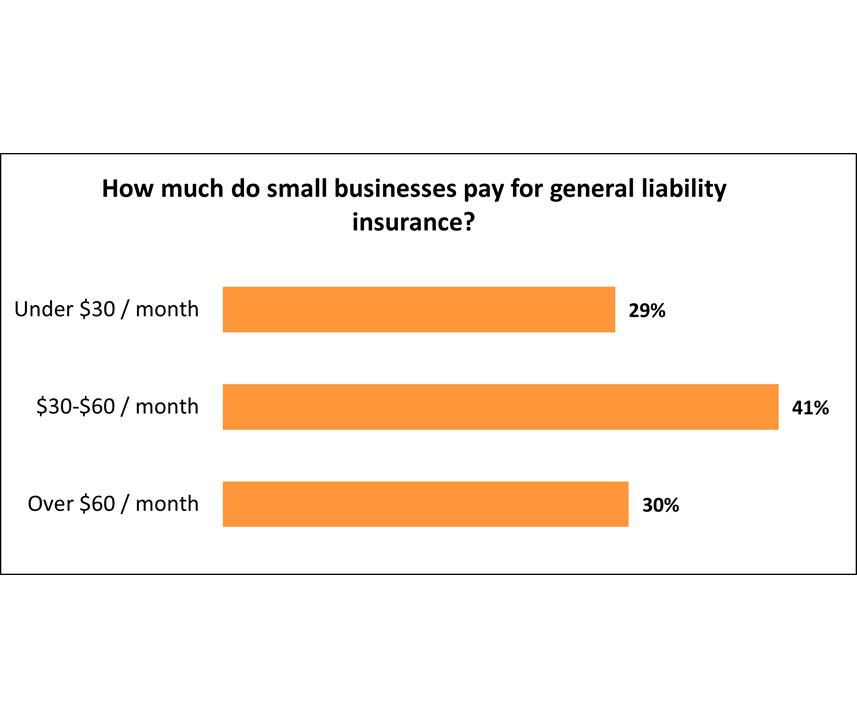

Liability coverage is legally required in North Carolina and pays for injury pain and suffering lost wages and property damage that you cause to another driver in an at-fault accident. 25000 for bodily injury to or death of one person 60000 for bodily injury to or death of more than one persons. A typical policy may include bodily injury and property damage personal injury liability and legal defense and judgement.

Liability Car Insurance Minimums in North Carolina. Start Your Free Online Quote And Save 610. As in other personal injury cases reaching out to an attorney to assist is typically the best approach.

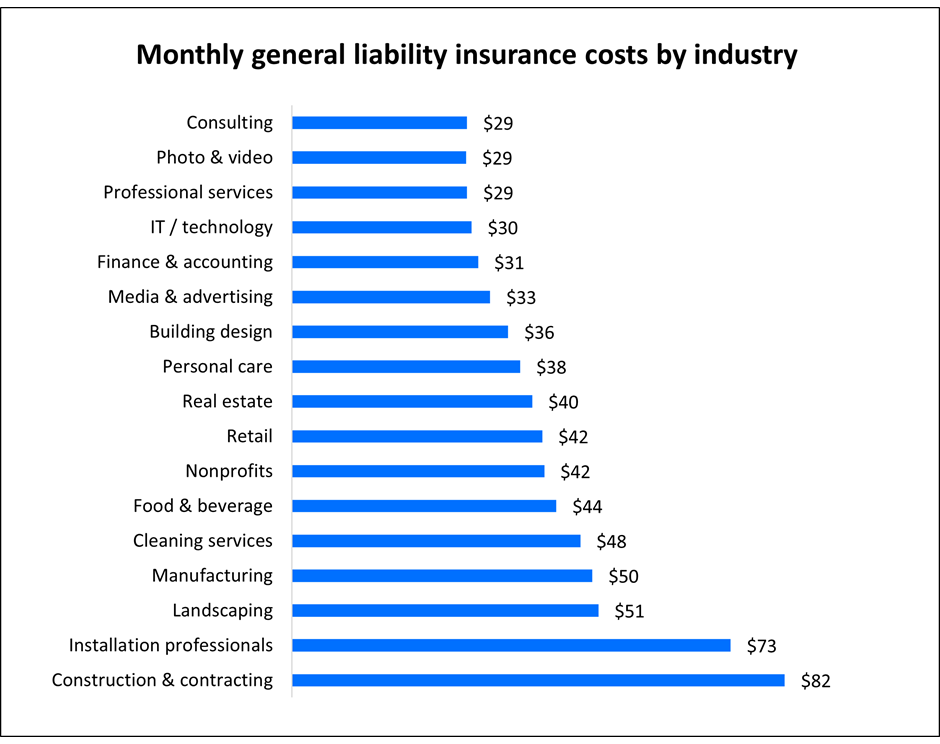

Though not required by North Carolina law most North Carolina businesses choose to protect themselves from financial loss and maintain a general business liability insurance policy. This is why maintaining professional liability insurance is so crucial for every law firm to have. Liability coverage in North Carolina.

:max_bytes(150000):strip_icc()/FiduciaryLiabilityInsurance_GettyImages-1095046944-bae773bf055a4fb08303382e90fad44a.jpg)